American Family Everyday Concerns

Fall Semester, No Funds: Why Federal Student Aid Is MIA (Missing in Action)

The first reason is the delays in the FAFSA and financial aid system. Technical glitches and setbacks have pushed the 2025-2026 aid forms into summer. Schools can't allocate loans until FAFSA information is verified and matched with enrollment records.

The second reason is the reduction in hiring within the Department of Education. Budget cuts have weakened financial oversight and student assistance, creating gaps in many universities.

The third reason involves the Office of Management and Budget (OMB) halting FAFSA student aid. In early 2025, Federal Grants and Loans were suspended for formal evaluation, despite legal barriers. This caused widespread confusion and delays.

As a result, even in June 2025, many students and parents remain uncertain if they will receive Federal Grants and Loans or attend their dream schools. This uncertainty bodes ill for the nation, particularly for its youth.

6/9/2025

Stock Market Highlight

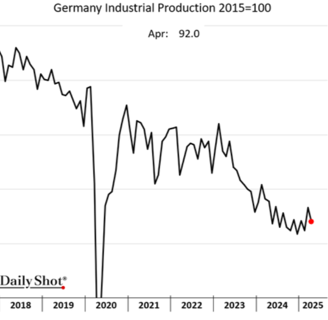

Why Are European Stocks Are Booming - It's a U.S. Retreat

6/9/2025

European stocks are rallying not because Europe uncovered a hidden economic boom, but because U.S. trade-posture instability has made Europe look comparatively solid. With more tariff delays, ECB support, and investor flight from U.S. risk, European markets are getting a major lift.

European equity gains are less about local fundamentals, more about global rebalancing driven by U.S. policy uncertainty.

Market drivers include:

Trade tension relief

Monetary policy divergence favoring Europe

Capital rotation out of U.S. equities

German and French stocks outperforming U.S. benchmarks reflect this shift.

Interest Rate Highlight

6/8/2025

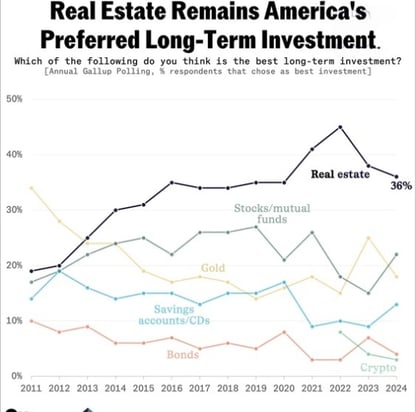

Owning a Home is Still the #1 American Dream

Interest Rate Highlight

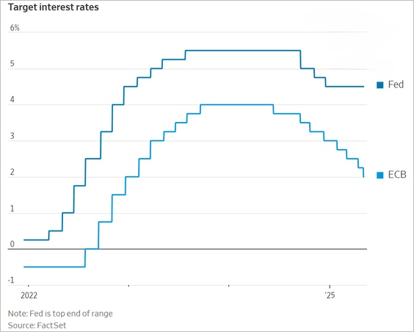

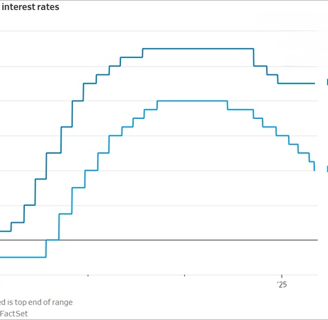

Monetary Mismatch: ECB’s Bold 8 Cuts vs. Fed’s Cautious 3

6/8/2025

Stock Market Highlight

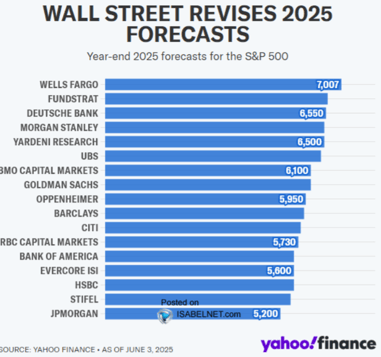

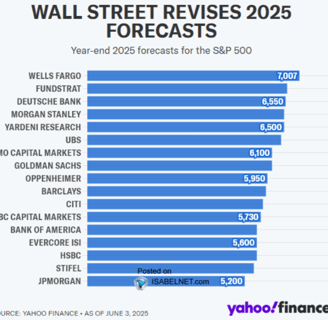

Banks Say Save, Investment Banks Say Invest — Choose Your Next Move Wisely

Curry S&P 500 level

6/5/2025

Stock Market Highlight

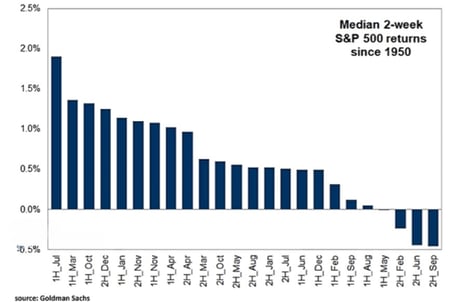

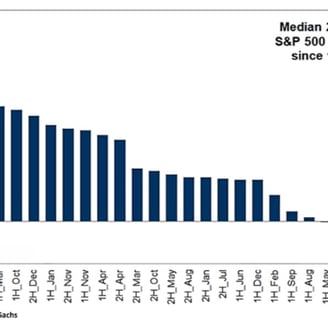

Caution Ahead: 2nd Half of June Has a Weak Track Record

6/5/2025

Stock Market Highlight

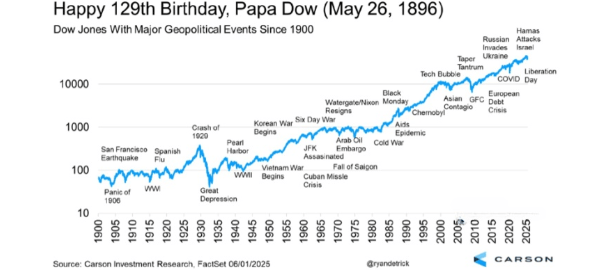

Happy 129th Birthday, Papa Dow! A Legacy Still Leading Global Markets

6/5/2025

Stock Market Highlight

S&P 500 Year-end Target: 6550

6/4/2025

Stock Market Highlight

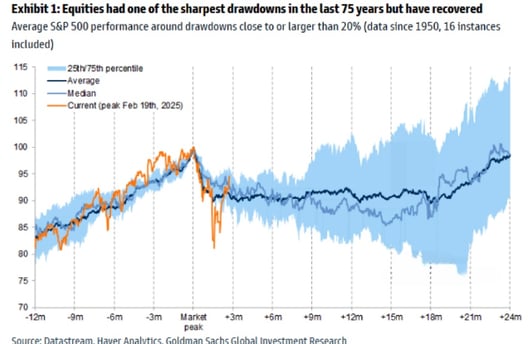

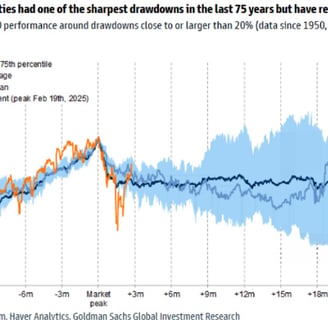

Cautious Optimism Builds Around U.S. Stocks Ahead of October This Year

5/15/2025

Tariff Highlight

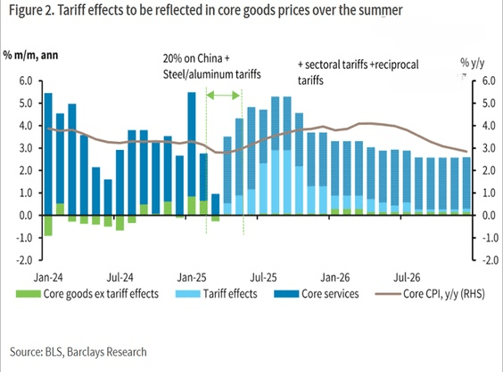

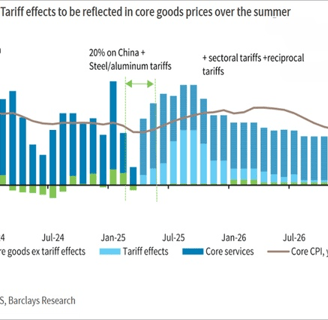

White House Bets on Short Memories Next Year as Tariff-Driven Inflation Set to Worsen in Q3 2025

5/15/2025

Economy Highlight

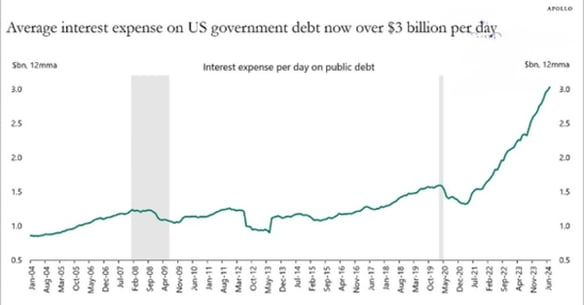

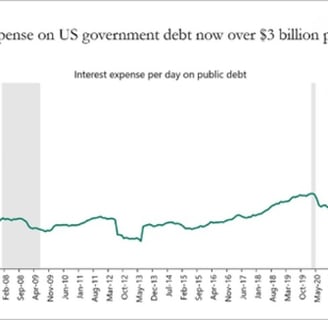

U.S. Debt Interest Soars Past $3B Per Day

America is now shelling out over $3 billion per day just to pay interest on its national debt.

That’s not even touching the principal! Since 2021, the curve has skyrocketed 📈, fueled by rising interest rates and ballooning debt levels. It’s like maxing out your credit card, then paying triple-digit interest just to tread water. 🧊 This could squeeze future budgets, hike taxes, and pressure public services. Time to ask: how sustainable is this financial treadmill? 🤔📊 Buckle up. The debt ride is getting more expensive.

5/2/2025

Currency Highlight

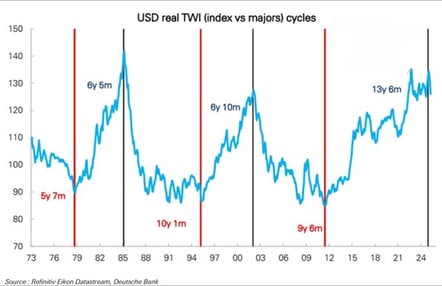

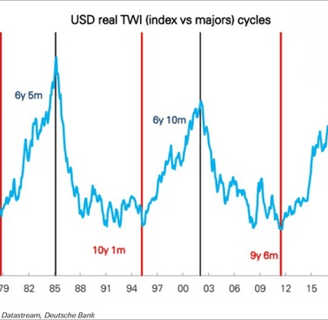

Dollar’s Long Decline Has Started

Is the mighty USD about to tumble again? 📉💸

History might be repeating itself—again. This chart shows the U.S. dollar’s real value doing a decade-long up-and-down dance 💃. And guess what? We might be at the peak of the current climb and start to decline. Every time the dollar hit a high like this, it slid downhill for years—sometimes ten! That 13-year bull run? Might be saying goodbye. So if you’ve got travel dreams or overseas investments, keep those 👀 wide open. The dollar may start softening, and it could stick around for a while. Buckle up—the greenback could be in for a bumpy ride. 💸🌍📉

4/30/2025

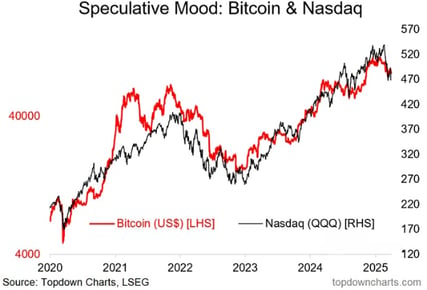

Crypto Highlight:

Bitcoin Isn’t Your Hedge—It Rides the Same Wave as Stocks

Despite its hype as digital gold, Bitcoin often moves in sync with equities—making it a risky bet for investors looking to hedge against stock market volatility.

4/3/2025

Subscribe for Email Notifications

Disclaimer: Not financial advice. ⚠️💰🚫

Copyright © 2025 market AI master All Rights Reserved. Disclaimer: All information given is purely for educational purposes and should not be considered investment advice.