Trading Blog

Disclaimer: Not financial advice. ⚠️💰🚫

2025 Trading Strategy:

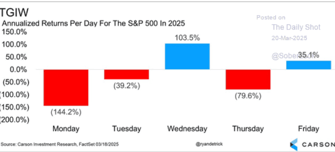

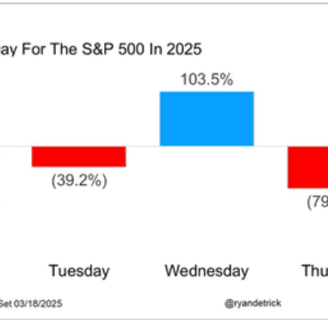

Equity price too high, market more choppy, focus on buying dips.

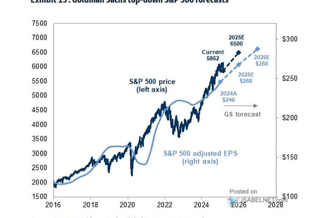

SPY '25 year end estimate: 6500. Buy QQQ, QQQM, IWM, IWY.

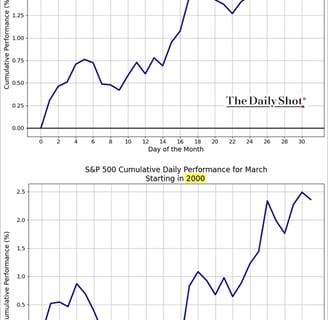

March '25 market recovery after 3/16.

Middel East War disrupt supply chain. Oil prices going up.

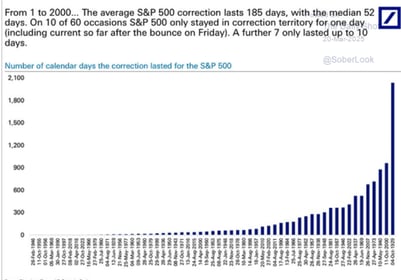

Median length of correction lasted 52 days (2.5 months)

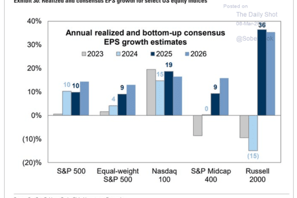

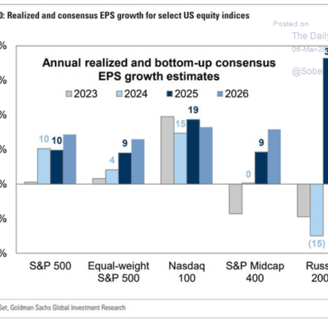

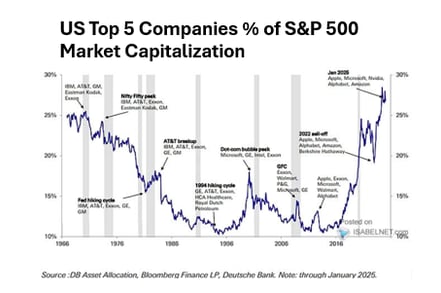

❌Mag 7 growth slowing down. Sell IJH.

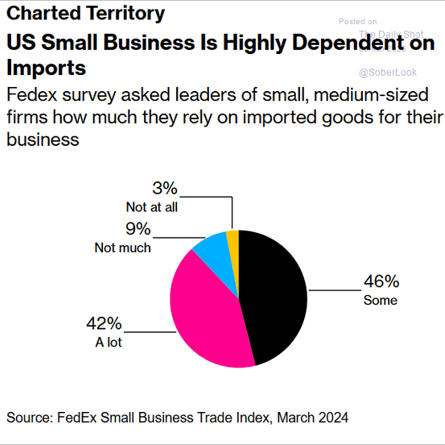

❌Tarriffs damage small business more in the beginning.

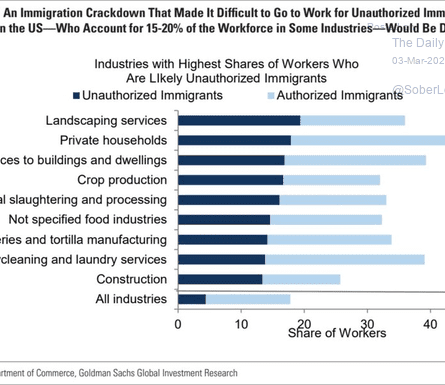

❌Immigation affects landscaping, construction, and agriculture more than others.

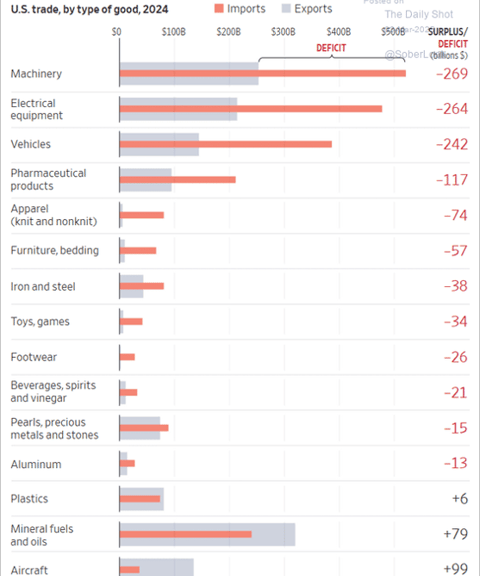

❌Negative Tariff impact: XLI, XLRE, XLV,vehicles.

Highest Tariff Impact:

Machinery, elctronics, vehicles, and medicine.

Small Business Are Doomed...

3/32025

U.S. Defense ETFs

1️⃣ iShares U.S. Aerospace & Defense ETF (ITA) – Tracks major defense contractors like Lockheed Martin, Raytheon, and Boeing.

2️⃣ SPDR S&P Aerospace & Defense ETF (XAR) – Equal-weighted ETF with exposure to both large and mid-sized defense firms.

3️⃣ Invesco Aerospace & Defense ETF (PPA) – Follows the Aerospace & Defense Index, holding a mix of weapons manufacturers and military suppliers.

4️⃣ Fidelity Select Defense & Aerospace Portfolio (FSDAX) – Actively managed fund investing in U.S. defense giants.

Here are the expense ratios for the mentioned U.S. defense ETFs:

iShares U.S. Aerospace & Defense ETF (ITA): 0.39% theluxuryplaybook.com+1investopedia.com+1

SPDR S&P Aerospace & Defense ETF (XAR): 0.35% finance.yahoo.com

Invesco Aerospace & Defense ETF (PPA): 0.58% portfolioslab.com+5benzinga.com+5investopedia.com+5

Fidelity Select Defense & Aerospace Portfolio (FSDAX): 0.75% benzinga.com

3/3/2025

Is Betting on the Magnificent 7 Still a Winning Strategy in 2025?

Yes or No?

2/28/2025

RIP 💀📞Skype

Starting in May 2025, Skype will be shut down forever. 💀📞

Skype was released in 2003 and was then bought by Microsoft in 2011 for $8.5bn. After 22 years, it’s the end of the rope.

2/28/2025

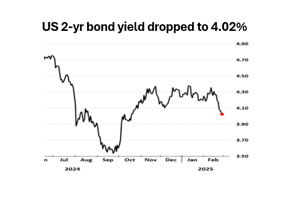

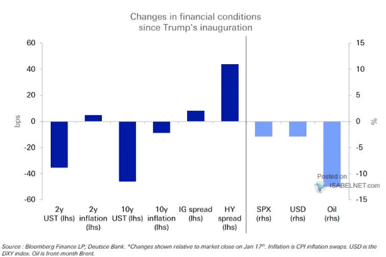

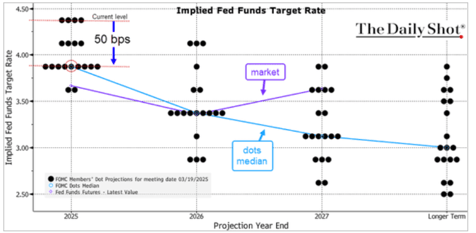

Why Is the 2-Year Yield Dropping and Prices Surge? Fed Policy Rate to 3.75% by the end of 2025?

Yields are dropping, bonds in demand,

The Fed might cut—that’s what’s planned. 📉💰

Fear of slowdown, folks play it safe,

Cash flows to Treasuries, a safer place. 🏦🔄

Cheaper loans for biz, a welcome break,

Small firms grow, more jobs to make. 💼📊

Trump says, ‘Yields must fall, rates should be low,’

Boosting the economy, letting business flow. 🚀💡

2/28/2025

U.S. Recession is Coming?

Recession fears? Don’t buy it.

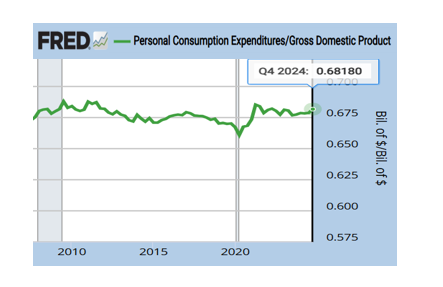

With personal consumption at 68.18% of real GDP, the economy looks just fine. 🚀📊

2/27/2025

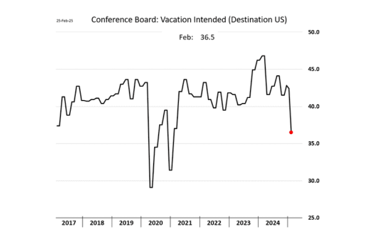

Job Worries Rise as Americans Cut Back on Travel

Job opportunities are shrinking, making Americans cautious about spending. Fewer people are planning vacations, so hotel and airline stocks may struggle.

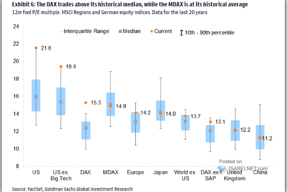

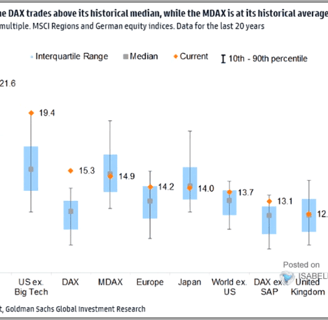

Consumer confidence is down, but CEOs remain optimistic. Meanwhile, big tech stocks are in correction territory after a long rally.

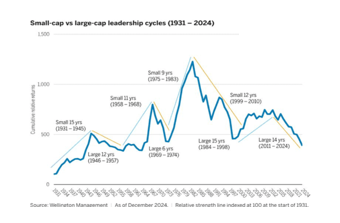

On the bright side, U.S. small caps might offer potential opportunities for investors willing to take risks.

2/26/2025

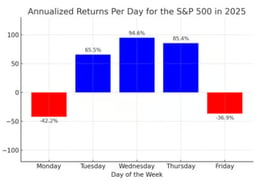

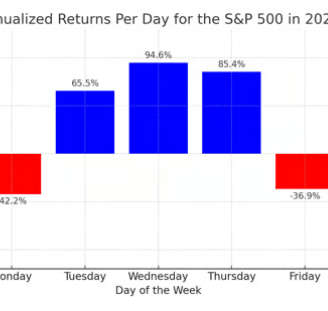

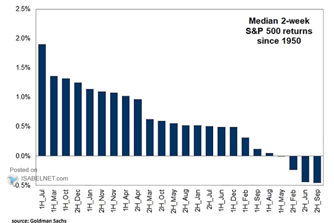

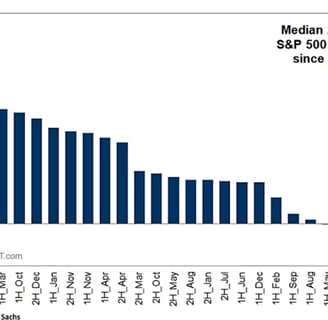

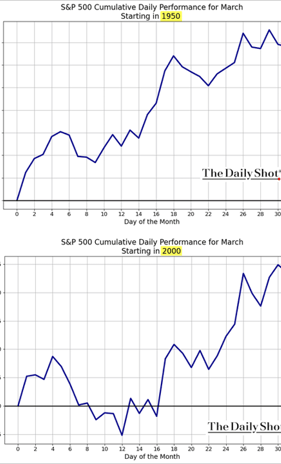

Seasonality: March low 1H and higher 2H

Mar 2025

Copyright © 2025 market AI master All Rights Reserved. Disclaimer: All information given is purely for educational purposes and should not be considered investment advice.